Business Process and Information Flow Charting:

Every business organization has a proper and well-defined hierarchy. That hierarchy defined the designation and responsibility of every person who has a stake and role in the business operations process and has a direct or indirect linked with its operations. That same thing is well defined and managed when the process and operations of the business explained.

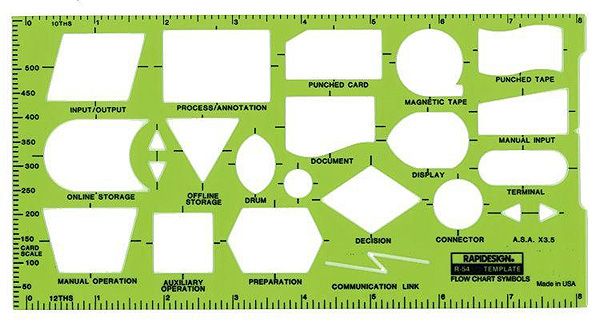

That business process operations and information flow are now represented through practical symbols which are called flowcharting. The Flowchart explained each and every activity of the business operations and its process cycle.

The Flowchart can be explained horizontally and vertically in both shapes. The Horizontal Flowchart also has known as system flow chart. It tells us about the responsibilities of department and functions in vertical columns. The Activities processes and document flow in forth across lines. Same like Vertical Flowchart is present successive steps in a top –to- bottom format.

The Flowchart explained the processes with practical symbols. It explained about periodic backup and rotation and complete backup routine. That helps the business organization in case of any disaster recovery, in every process, there is a contingency plan which is well explained and it also tells us about the alternative processing facilities to overcome the loss.

The Business use normally flowchart to explain it information flow and financial transaction and information or system. It is mostly used as system controlling tool to control all the business processes.

Comments

Post a Comment