Economics

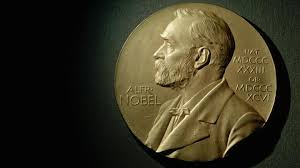

Professor Richard H Thaler awarded Nobel Prize-2017:

Every Year the Committee of Nobel

Prize distributes the Nobel Prize to many people of the world in different categories

who served outstandingly with courage, extraordinarily for the humanity, and mankind. This year in

2017 the Nobel Prize for Economics awarded to Professor Richard H Thaler.

He served as

a Professor and a facility member of University of Chicago and he awarded over

his outstandingly contribution to behavioral economics. Professor Richard H

Thaler born in 1945 in east orange. He worked in the field of integrated

economics with psychology.

In his honor

in a statement, issued, The Royal Swedish Academy of Science said that “ The

Sveriges Riksbank Prize in Economics Science, in memory of Alfred Nobel -2017,

has been awarded to Richard H Thaler for having incorporated psychologically

realistic assumptions into analyses of economic decision making. By exploring

the Consequences of limited rationality, social preferences, and lack of

self-control, he has shown how these human traits systematically affect

individual decisions as well as market outcomes,.” The statement read and over

the last few days, former RBI Governor and renowned economist RaghuramRajan was also among those outstanding personalities who have been

nominated for such a top class award.

The Nobel

Prize Committee does not disclose the names of those nominated for 50 years.

“That

News taken from MSN-India page, when they published the news of The IndianExpress about the Economics Nobel Prize for the year of 2017”

Comments

Post a Comment